When you need a generic medication like lisinopril or metformin, you might think ordering it online is the easiest way to save money. But if you're relying on insurance, things get complicated fast. Not every online pharmacy accepts your insurance. Some do-but only under strict rules. Others don't accept it at all, leaving you to pay full price and hope for reimbursement. The truth is, insurance coverage of online pharmacy generics isn't about where you shop-it's about how your plan works.

How Insurance Actually Covers Generic Drugs

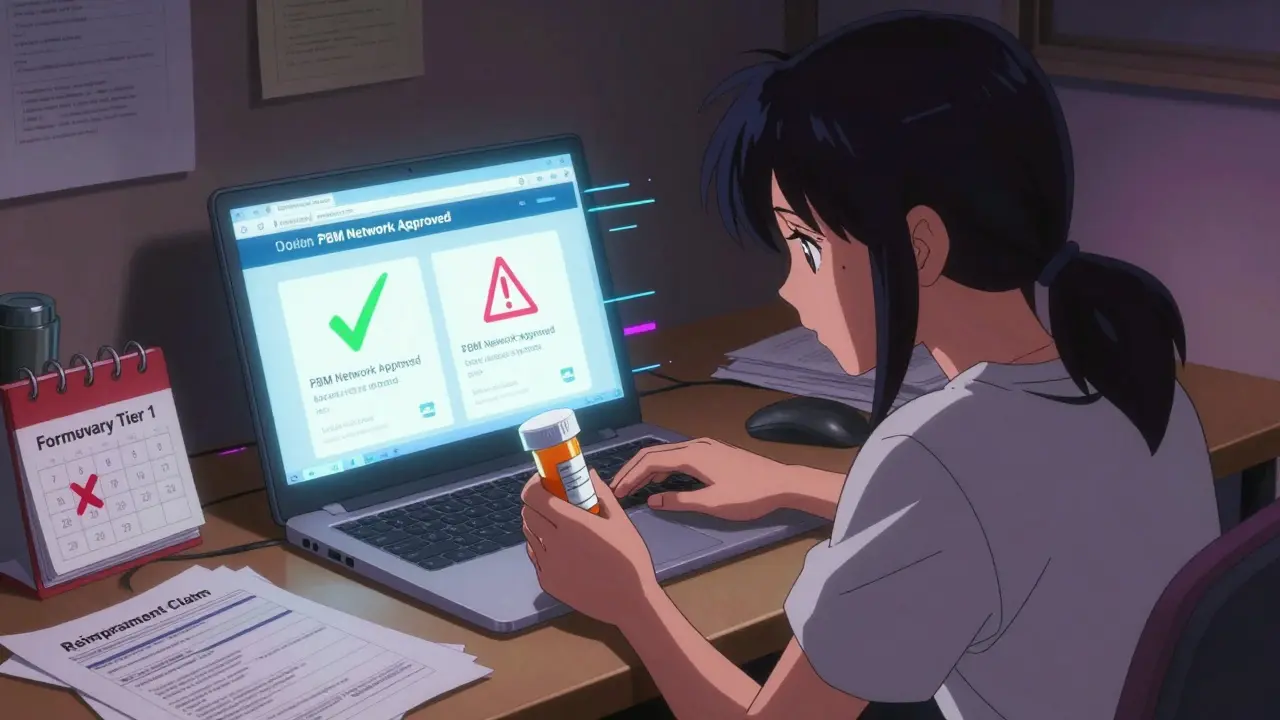

Your health plan doesn't just pay for drugs. It controls which ones you can get, at what price, and through which pharmacies. This system is managed by pharmacy benefit managers (PBMs), companies like CVS Caremark, Express Scripts, and Optum Rx. They create your plan's formulary-a list of approved drugs grouped into tiers. Generics sit at the bottom tier because they're cheaper. For most plans, a 30-day supply of a generic costs $5 to $10 at a retail pharmacy. A 90-day supply through mail order? Often $10. That's a 33% savings per dose. But here's the catch: you can't just pick any online pharmacy. Only those connected to your PBM's network qualify for these low copays. If you order from an independent online pharmacy-like one you found through a Google ad or a social media promo-you're likely outside the network. That means your insurance won't pay anything. You'll pay full price, submit a claim, and wait weeks for a partial refund-if you get one at all. Most people don't bother. They just pay out of pocket.Mail-Order vs. Independent Online Pharmacies

There's a big difference between mail-order pharmacies run by your insurer and random websites selling pills online. Mail-order services are part of your insurance plan. You get a 90-day supply delivered to your door. It's cheaper, but you need a doctor to write a 90-day prescription. Some plans require prior authorization, which can take days. Delivery takes about a week, so it won't work for urgent needs like antibiotics or post-surgery meds. Independent online pharmacies? They're like Amazon for pills. Some accept insurance. Some don't. Some let you pay with a credit card and submit receipts later. But they're not part of your PBM's network. That means no guaranteed pricing. No guaranteed coverage. And no protection if the pills are fake, expired, or mislabeled. A 2023 study found that 42% of patients didn't realize their insurance didn't cover all online pharmacies. One woman in Ohio ordered her cholesterol med from a site she trusted. She paid $75. Her insurance later reimbursed her $12. She was out $63.Amazon RxPass and Other New Models

Amazon Pharmacy's RxPass is changing the game. For $5 a month, Prime members get access to over 100 common generic medications-no copay, no insurance needed. It's not insurance. It's a subscription. And it's working. Users love it. Reviews on Trustpilot average 4.3 out of 5. People use it for blood pressure meds, thyroid pills, and diabetes drugs. But it has limits. Not every generic is included. If you need a less common drug, you're back to square one. And you need a Prime membership. That's $14.99 a month or $139 a year. Still, it's a wake-up call. Why pay $10 every 90 days through insurance when you could pay $5 a month flat? It's not about insurance anymore-it's about value.

Non-Medical Switching: When Your Insurance Chooses Your Meds

You might not know this, but your doctor doesn't always get the final say. Insurers can force you onto a generic-even if your doctor prescribed the brand name. This is called non-medical switching. It happens because PBMs make money when you use cheaper drugs. If your plan drops the brand from its formulary, your copay for it might jump from $15 to $150. Suddenly, the generic looks like the only option. A patient in Michigan switched from Copaxone to a generic MS drug without warning. She developed severe side effects. She ended up in the ER. Her insurance refused to cover the ER visit because the switch wasn't medically approved. You have rights. You can ask for a formulary exception. Your doctor can submit paperwork explaining why the brand is necessary. But it takes time. And paperwork. And patience.How to Check What Your Insurance Covers

Before you order anything online, do this:- Log into your insurance member portal. Look for a tool called "Check Drug Cost & Coverage" or "Medicine Search."

- Enter the name of your generic drug. Make sure it's spelled exactly as it appears on your prescription.

- Check the tier. Is it covered? What's the copay?

- Look for the "preferred pharmacy" list. Is the online pharmacy you're considering on it?

- Call your insurer. Ask: "If I order this generic from [Pharmacy Name], will my insurance cover it?" Record the name of the rep and the date.

What to Do If Your Insurance Denies Coverage

If your plan refuses to cover a generic you ordered online:- Don't pay full price unless you're sure it's cheaper than your copay.

- Ask for a claim form. Submit your receipt and prescription.

- Call your insurer's pharmacy help line. In the UK, many plans offer free nurse advice lines. Use them.

- If you're on Medicare, check if the drug is covered under Part D. Some online pharmacies are approved for Medicare Part D.

- If you're still stuck, contact your state's insurance commissioner. Many states now cap out-of-pocket costs for generics.

The Bigger Picture: Why This Matters

By 2025, nearly half of all generic maintenance medications will be delivered to your home-either through mail-order or subscription services. Insurance companies are pushing this because it's cheaper for them. But it's not always better for you. The real issue isn't online pharmacies. It's lack of transparency. You shouldn't have to be a detective to know if your insurance covers your meds. You shouldn't have to risk your health because your insurer wants to save money. If you're on a long-term medication, ask your doctor: "Is there a generic? Is it covered? Can I get it through mail order?" Then, ask your insurer: "Which pharmacies do you cover for this drug?" Write it down. Keep it with your prescription. You're not just buying pills. You're navigating a system designed to save money-not to make things easy.Do all online pharmacies accept insurance?

No. Only pharmacies connected to your insurance plan's pharmacy benefit manager (PBM) network accept insurance. Most independent online pharmacies don't. Always check your insurer's preferred pharmacy list before ordering.

Can I use my insurance at Amazon Pharmacy?

Amazon Pharmacy doesn't process insurance claims. Instead, it offers RxPass-a $5 monthly subscription for over 100 common generics. If you're a Prime member, this can be cheaper than your insurance copay. But if you need a drug not on the RxPass list, you'll pay full price.

Why is my generic cheaper at Walmart than my insurance copay?

Some retailers like Walmart, Costco, and Target offer flat $10 prices for 90-day supplies of common generics-no insurance needed. If your insurance plan has a high deductible or high copay, paying cash can be cheaper. Always compare the price before using insurance.

What is non-medical switching?

Non-medical switching is when your insurance forces you to switch from a brand-name drug to a generic-even if your doctor didn't recommend it. This is done to cut costs. You can request an exception, but you'll need your doctor to submit paperwork proving the brand is medically necessary.

How do I know if my online pharmacy is safe?

Look for the VIPPS seal (Verified Internet Pharmacy Practice Sites) or check the National Association of Boards of Pharmacy's list of licensed pharmacies. Avoid sites that sell without a prescription, offer "miracle cures," or have no physical address. If it seems too good to be true, it probably is.

Can I get reimbursed if I pay out of pocket at an online pharmacy?

Maybe. Some plans allow you to submit receipts for out-of-network pharmacy purchases, but reimbursement is often partial and takes weeks. You'll need your prescription, receipt, and proof of payment. Many people find it's not worth the hassle-especially if the out-of-pocket cost is higher than your copay.

Wilton Holliday

December 24, 2025 AT 00:24Just ordered my metformin through Amazon RxPass last month. $5/month is insane compared to my $15 copay. No insurance hassle, no waiting for mail-order approvals. I’m a Prime member anyway, so it’s basically free money. 🙌

Raja P

December 24, 2025 AT 20:02Bro, in India we just buy generics from local chemists for like $2 a month. Online? Nah. We don’t trust random websites. But if you’re in the US and your insurance is a nightmare, I get it. Just don’t fall for those ‘buy 1000 pills for $20’ ads. Seen too many people get fake meds.

Joseph Manuel

December 25, 2025 AT 03:06The premise of this article is fundamentally flawed. Insurance coverage is not the issue-PBM greed is. The entire system is designed to extract profit from patients under the guise of cost containment. The fact that Amazon RxPass works better than your insurance is not innovation-it’s a indictment of a broken, corporate-controlled healthcare infrastructure. You’re not saving money-you’re being exploited by middlemen.

Harsh Khandelwal

December 25, 2025 AT 21:33So let me get this straight-your ‘insurance’ is run by some corporate robot that doesn’t even know your name, and you’re supposed to trust some shady website with your heart meds? 😂 I’ve seen videos of pills being shipped in unmarked envelopes from Bangladesh. One guy got a box of chalk and a note that said ‘take 2 daily.’ Insurance might suck, but at least your local CVS doesn’t send you placebo powder.

Andy Grace

December 26, 2025 AT 20:01I’ve been on blood pressure meds for 8 years. I switched to mail-order through my insurer last year. Took 3 weeks to get the first refill, but the price was half. I just learned to plan ahead. Not perfect, but better than paying $80 out of pocket every month. Still, I wish the system was clearer.

Delilah Rose

December 27, 2025 AT 03:36Okay, but have you thought about how this affects elderly people who don’t use smartphones? Or people with limited English? Or those who don’t have reliable mail delivery? The whole system assumes you’re tech-savvy, organized, and have time to fight with insurance reps for weeks just to get your diabetes meds. It’s not just inconvenient-it’s dangerous. My grandma nearly had a stroke because she took the wrong pill after her insurer switched her without telling her. She didn’t even know what ‘non-medical switching’ meant. That’s not healthcare. That’s a gamble with people’s lives.

Spencer Garcia

December 28, 2025 AT 17:27Always check the PBM’s preferred pharmacy list. It’s the only way to avoid getting screwed. Walmart’s $10 generics are often cheaper than your copay too. Simple.

Lindsey Kidd

December 29, 2025 AT 16:10Amazon RxPass changed my life. 💊 I used to stress every month about whether I could afford my lisinopril. Now I just click ‘add to cart’ and forget about it. No forms, no calls, no ‘prior authorization’ nonsense. And yes, I’m a Prime member-but $140 a year for peace of mind? Worth it. Also, the customer service actually answers the phone. 🤯

Austin LeBlanc

December 31, 2025 AT 10:27You’re all just sheep. You think Amazon gives a damn about you? They’re making you dependent so they can jack up prices later. And your ‘insurance’? It’s a scam. They want you to pay out of pocket so they can charge you more later for ‘premium coverage.’ Wake up. This isn’t about savings-it’s about control. They’re turning your medicine into a subscription service. Next thing you know, they’ll charge you for breathing.

Charles Barry

January 1, 2026 AT 05:23They’re all in on it. The PBMs, the pharmacies, Amazon, even your doctor. They’re all part of the Pharma Cartel. You think your ‘generic’ is really generic? Nah. It’s made in a lab in China that’s owned by the same company that makes the brand. They just changed the label. Your ‘$5’ pill? Costs them 12 cents to produce. You’re being played. And the government? They’re in on it too. You think they don’t get kickbacks? Look at the revolving door between FDA and big pharma. This isn’t healthcare-it’s a Ponzi scheme with pills.

Lu Jelonek

January 1, 2026 AT 18:41In my community, we’ve started a group chat where we share which online pharmacies actually work. One guy found a Canadian site that ships to the US with real prescriptions and accepts insurance. We verify every pharmacy through NABP before using it. It’s not perfect, but it’s better than getting ripped off. Knowledge is power.

Ademola Madehin

January 2, 2026 AT 14:45I ordered my thyroid meds from some site that said ‘90% OFF’ and now I’m terrified I got poison. I’ve been checking my pulse every hour. My skin is breaking out. My mom cried. I just wanted to save $30. Now I’m scared I’m gonna die because I trusted a guy named ‘PharmaKing420’ on Instagram. 😭 Someone help me. I don’t know who to call. I don’t even know if I’m alive.

suhani mathur

January 4, 2026 AT 06:21Wow. So you’re telling me the system is so broken that paying cash at Walmart is smarter than using insurance? And we’re supposed to be impressed? 🤡 My copay is $10, but my deductible is $6k. So technically, I’m paying $10… but only after I’ve spent $6k on other stuff. Thanks, insurance. You’re a real lifesaver. 😘