Getting your medicine every month shouldn’t feel like a gamble. But for millions of people, the price tag at the pharmacy counter makes them choose between taking their pills and paying for food, rent, or heat. Medication adherence isn’t just about remembering to take your pills-it’s about being able to afford them. And right now, too many people are skipping doses, splitting pills, or not filling prescriptions at all because they simply can’t pay.

Why Cost Keeps People from Taking Their Medicine

It’s not laziness. It’s not forgetfulness. It’s money. According to the CDC, 8.2% of adults under 65 skipped or cut back on their prescriptions last year because of cost. That’s nearly 1 in 12 people. For older adults on Medicare, the number is even higher-14.4% reported cutting back on meds due to price. And it’s not just insulin or cancer drugs. People are rationing blood pressure pills, diabetes meds, cholesterol treatments, and even antidepressants.

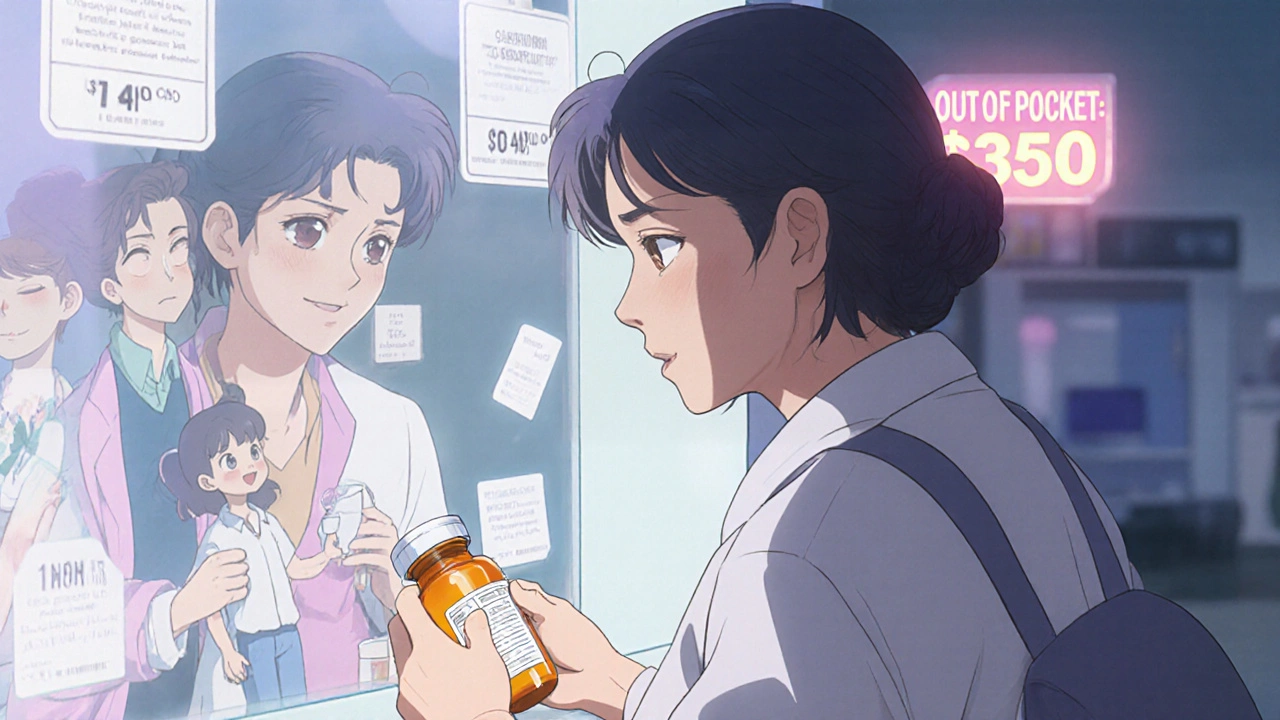

When a copay jumps from $10 to $50, adherence drops by 15-20%. That’s not a small dip-it’s a cliff. A study in the American Journal of Managed Care found that patients were far more likely to stop taking their meds entirely when out-of-pocket costs rose. And it’s not just the monthly price. High deductibles, coinsurance, and tiered formularies mean you might think your insurance covers a drug… until you get to the pharmacy and see a $300 bill for a 30-day supply.

People with chronic conditions like heart disease or diabetes are hit hardest. These aren’t short-term fixes-they’re lifelong treatments. One 62-year-old woman in a Kaiser Health News survey said she pays $350 a month for her meds after Medicare Part D. That’s more than her electric bill. She’s forced to pick between her prescriptions and groceries. That’s not a choice anyone should have to make.

The Human Cost of Skipping Doses

When people don’t take their meds, the consequences aren’t theoretical. They’re deadly. The American Heart Association estimates that poor medication adherence causes about 125,000 deaths in the U.S. every year. That’s more than traffic accidents. It’s also incredibly expensive. Non-adherence leads to $100-$300 billion in avoidable hospital visits, ER trips, and complications annually.

People aren’t just skipping pills-they’re doing dangerous things to stretch their supply. Reddit threads are full of stories: splitting pills in half, taking every other day, waiting weeks to refill because they can’t afford it. One man on r/healthcare said he pays $800 a month for insulin-even with insurance. He’s been rationing it for years. His blood sugar is unstable. His doctor knows. But what’s the alternative? Quitting his job to get better coverage? Moving to a cheaper state? Neither is easy.

And it’s not just about physical health. Mental health meds are often the first to go. Depression, anxiety, bipolar disorder-these conditions don’t wait until you can afford them. But when the cost is $200 a month, and you’re working two jobs just to keep the lights on, the pills get left behind. The long-term toll? More hospitalizations, more lost workdays, more broken families.

How to Get Help: Real Solutions That Work

There is help-and it’s not as hard to find as you might think. The first step? Talk to your doctor. Not just about your symptoms. Talk about your wallet. A 2023 Medscape survey found that 65% of doctors now routinely ask patients about medication costs. That’s up from 42% just five years ago. Your doctor can switch you to a cheaper drug on your insurance’s formulary, or even one that’s on a discount list.

Pharmaceutical companies run patient assistance programs. In 2022, these programs helped 1.8 million Americans. If your income is below $55,520 as an individual (400% of the federal poverty level), you may qualify for free or deeply discounted meds. For insulin, some manufacturers now offer $35 monthly caps for those without insurance. Others give you $0 copays if you meet income guidelines. You don’t need to be poor to qualify-just struggling.

GoodRx and SingleCare are free tools that show you the lowest cash price for your prescription at nearby pharmacies. They’re not insurance. They’re coupons. And they often cut costs by 50-80%. One woman with type 2 diabetes used GoodRx to drop her insulin cost from $500 to $25 a month. Her adherence jumped from 60% to 95%. That’s not luck-that’s information.

If you’re on Medicare, check out Extra Help. This program covers up to $5,000 in drug costs per year for low-income beneficiaries. You can apply through Social Security. And starting in 2025, Medicare Part D will cap your out-of-pocket spending at $2,000 a year. That’s huge. It means no more “donut hole” surprises.

Other Ways to Lower Your Drug Costs

Ask for a 90-day supply. Many insurers charge the same copay for a 90-day refill as they do for 30 days. That means you pay less per pill-and you’re less likely to run out. Mail-order pharmacies often offer this option, and some even deliver to your door.

Ask your doctor for samples. About 32% of patients who worry about cost say they’ve received free samples. It’s not a long-term fix, but it can buy you time to apply for assistance programs.

Use generic drugs. The FDA approved over 1,100 generics in 2022. These are the same as brand-name drugs, just cheaper. If your doctor prescribes a name-brand statin, ask if a generic version is available. Chances are, it is-and it costs a fraction.

Check out the Partnership for Prescription Assistance. They connect people to over 470 programs from drugmakers, nonprofits, and government agencies. No sign-up fees. No hidden costs. Just a simple form and a phone call.

What’s Changing in 2025 (And Why It Matters)

The Inflation Reduction Act is starting to make a real difference. Starting in 2024, Medicare Part D eliminates the coverage gap. In 2025, the $2,000 annual out-of-pocket cap kicks in. That means no matter how expensive your meds are, you won’t pay more than that in a year.

And there’s something new: the Medicare Monthly Payment Plan (M3P). Starting in 2025, you’ll be able to pay for high-cost drugs in monthly installments instead of one big lump sum. If your insulin costs $600 a month, you won’t have to pay it all at once. You’ll pay $150 a month for four months. That’s life-changing for people living paycheck to paycheck.

But here’s the catch: these changes don’t help people under 65. For non-Medicare patients, the system is still broken. Insulin prices have tripled since 2007. The average cost of a prescription in the U.S. is higher than in any other developed country. And real-time benefit tools-apps that show drug prices at the point of prescribing-are still inconsistent. One study found that 37% of estimated prices were off by more than $10. That’s not reliable. That’s frustrating.

What You Can Do Right Now

Don’t wait for policy changes. Don’t assume you’re on your own. Here’s your action list:

- Ask your doctor: “Is there a cheaper alternative?”

- Search your prescription on GoodRx or SingleCare before filling it.

- Call the drug manufacturer’s patient assistance line. Look up the name of your drug + “patient assistance program.”

- If you’re on Medicare, apply for Extra Help-even if you think you don’t qualify.

- Ask for a 90-day supply or mail-order pharmacy.

- If you’re struggling to pay, tell your pharmacist. They often know about local charities or discount programs.

Medication adherence isn’t about willpower. It’s about access. And access isn’t a privilege-it’s a right. If you’re skipping doses because of cost, you’re not failing. The system is. But you don’t have to accept it. Help is out there. You just have to ask for it.

Why do people skip doses because of cost?

People skip doses because the out-of-pocket cost of their prescriptions is too high compared to their income. Many face choices between paying for medicine, food, rent, or utilities. Even with insurance, high deductibles, copays, and coinsurance can make medications unaffordable. Studies show that when copays exceed $50, adherence drops by 15-20%.

Can I get my meds for free?

Yes, many pharmaceutical companies offer free or low-cost medications through patient assistance programs. Eligibility is usually based on income-often up to 400% of the federal poverty level. For example, insulin manufacturers now cap monthly costs at $35 for those without insurance. Programs like Patient Services Inc. and the Partnership for Prescription Assistance can help you apply.

Does Medicare help with drug costs?

Yes. Medicare Part D helps cover prescription costs, and the Extra Help program reduces out-of-pocket expenses for low-income beneficiaries-covering up to $5,000 in drug costs per year. Starting in 2025, Medicare will cap annual out-of-pocket spending at $2,000, and you’ll be able to pay for high-cost drugs in monthly installments.

Are generic drugs as good as brand-name ones?

Yes. Generic drugs contain the same active ingredients, work the same way, and are held to the same safety standards as brand-name drugs. The only differences are usually in color, shape, or inactive ingredients. Generics cost 80-85% less on average. Always ask your doctor or pharmacist if a generic version is available.

What if I can’t afford my meds and don’t qualify for assistance?

Talk to your pharmacist-they often know about local charities, nonprofit programs, or sliding-scale clinics. Some hospitals have financial aid offices that help patients with medication costs. Also, try GoodRx or SingleCare for cash discounts. Even if you don’t qualify for government aid, these tools can cut your bill in half.

Is it safe to split pills to save money?

Sometimes, but not always. Some pills are designed to release medicine slowly and shouldn’t be split. Others have coatings that protect your stomach or control absorption. Never split pills without asking your doctor or pharmacist first. It’s safer to ask for a lower-dose pill or switch to a cheaper alternative than to risk underdosing or overdosing.

Corra Hathaway

November 20, 2025 AT 14:51OMG I literally cried reading this. My mom’s on insulin and pays $400/month even with Medicare. She splits pills because she’s scared to miss a payment on her heater. We’re not poor-we’re just one emergency away from disaster. This system is broken and it’s killing people. 😭

Simone Wood

November 20, 2025 AT 20:52Look I get it but honestly its just lazy people who dont wanna work harder. If you cant afford meds maybe you shoulda thought about that before you got diabetes. My cousin got a second job and now she pays for everything. Its not rocket science. Stop playing victim.

jim cerqua

November 20, 2025 AT 21:00Let’s be real-this isn’t about affordability. It’s about the collapse of the American healthcare-industrial complex. Big Pharma is a cartel. Insulin cost 10 bucks in 1990. Now it’s 300? That’s not inflation-that’s theft. And the FDA? They sit on their hands while CEOs buy private islands. This isn’t a policy problem. It’s a moral failure dressed in corporate jargon.

And don’t even get me started on ‘patient assistance programs.’ You think a 72-year-old with dementia and no internet access is gonna navigate 470 programs? That’s like telling a drowning person to ‘try harder at swimming.’

Meanwhile, the same pharma execs who price-gouge insulin are donating to politicians who block price caps. It’s not a bug. It’s a feature. And we’re all just collateral damage in their quarterly earnings report.

And yes-I’ve seen people split pills. I’ve seen people skip doses to buy groceries. I’ve seen diabetic patients with HbA1c levels above 12 because they couldn’t afford the meds. And then the doctors say ‘compliance is low.’ No. Compliance is impossible.

It’s not about willpower. It’s about survival. And if you think someone choosing between insulin and rent is ‘irresponsible,’ you’ve never had to choose.

Donald Frantz

November 22, 2025 AT 16:20GoodRx saved my life. My statin went from $120 to $12. I didn’t even know these tools existed until my pharmacist mentioned it. I thought insurance was supposed to cover this. Turns out, insurance is a maze designed to confuse you into giving up. GoodRx is the cheat code.

Also-90-day fills. Do it. I save $80/month and don’t have to stress about running out. Pharmacies hate this because they lose foot traffic. But your health? That’s the priority.

And generics? Same exact chemical. Same FDA approval. Just no fancy marketing. Why pay $200 for a name-brand when the generic works the same? It’s not magic. It’s math.

Julia Strothers

November 23, 2025 AT 21:03Of course the government wants to ‘cap costs.’ That’s just the first step to full socialist healthcare. They’re coming for your freedom next. Why should I pay for someone else’s poor life choices? If you can’t afford meds, don’t get sick. Or better yet-move to Canada. Wait, no-they ration care there too. So what’s the solution? Stop having chronic diseases. Simple.

And why are we even talking about insulin? It’s been around since 1921. If you can’t afford 100-year-old science, maybe you shouldn’t be alive.

Cooper Long

November 25, 2025 AT 02:07Medication adherence is a public health imperative. The economic burden of non-adherence is quantifiable and staggering. The data presented is robust and aligns with peer-reviewed literature from JAMA and NEJM. The structural inefficiencies in pharmaceutical pricing are systemic and require policy-level intervention. Patient assistance programs are insufficient as standalone solutions.

Recommendation: Implement universal price transparency mandates at the federal level. Require real-time benefit tools to be accurate within ±$5. Mandate formulary alignment across all private insurers. These are not radical ideas. They are baseline standards for a functioning healthcare system.

Sheldon Bazinga

November 26, 2025 AT 00:08Bro. I got my blood pressure med for $5 on GoodRx. But like… why are we even talking about this? It’s 2025. We have AI. We have drones. We have free wifi in Starbucks. But you can’t get a $200 pill without a loan? This is the most american thing ever. Like we’re all just one missed paycheck away from becoming a TikTok medical horror story.

Also-insulin is $35 now? Cool. But what about the 10 other meds I take? Who’s gonna cap those? Nobody. So yeah. We’re all just rats in a wheel.

Sandi Moon

November 27, 2025 AT 03:16It’s fascinating how the American narrative insists on individual responsibility while the system is engineered for failure. The very notion that a person must ‘apply’ for life-saving medication is a grotesque parody of social contract theory. The pharmaceutical lobby spends $300 million annually lobbying Congress. That’s not capitalism. That’s feudalism with a corporate logo.

And let’s not pretend ‘patient assistance’ is altruistic. It’s PR. A way to deflect blame while maintaining obscene profit margins. The real solution? Nationalize drug production. End patent monopolies. And stop pretending this is a market failure. It’s a moral failure.

Pravin Manani

November 28, 2025 AT 14:44I work in a clinic in Mumbai and we see this exact issue-people skipping doses because they can’t afford meds. But here’s the thing: in India, we have community health workers who go door to door with generics. They track adherence. They help with applications. No one’s left alone. In the U.S., you’re expected to be your own case manager, pharmacist, lawyer, and financial advisor. That’s not healthcare. That’s survival mode.

There’s a solution: train and fund community navigators. Pay them. Let them help people apply for programs. Let them call pharmacies. Let them sit with patients and say, ‘You’re not alone.’ That’s what real care looks like.

Leo Tamisch

November 29, 2025 AT 14:11Existentially speaking, the pharmaceutical-industrial complex is the ultimate expression of late-stage capitalism: commodifying life itself. We are reduced to data points in a risk-assessment algorithm. Our bodies are balance sheets. Our adherence metrics are KPIs. The tragedy isn’t the cost-it’s that we’ve accepted this as normal.

When a man chooses between insulin and his daughter’s birthday cake, we are no longer a society. We are a market.

🫠

Daisy L

December 1, 2025 AT 04:27MY SISTER DID THIS. SHE WAS TAKING HER ANTIDEPRESSANTS EVERY OTHER DAY BECAUSE SHE COULDN’T AFFORD THEM. THEN SHE GOT INTO A CAR CRASH BECAUSE SHE WAS ZONING OUT. HER DOCTOR SAID ‘YOU NEED TO BE MORE CONSISTENT.’ I WAS LIKE-DUH, SHE’S BROKE. NOT LAZY. SHE’S A SINGLE MOM WORKING TWO JOBS. I HATE THIS SYSTEM.

Anne Nylander

December 2, 2025 AT 19:46you guys!! i just found out my dad’s cholesterol med is $15 on singlecare!! he’s been paying $140 for years!! i cried!! you can do this!! just ask!! your pharmacist will help!! don’t give up!! you got this!! 💪❤️

Franck Emma

December 4, 2025 AT 08:42I’m dying. My meds are $800 a month. I’ve been rationing. I’m tired. I’m scared. I’m 34. I don’t want to leave my kid.

Steve Harris

December 5, 2025 AT 07:02Thank you for writing this. I’ve worked in community health for 18 years. Every single day, I see people choosing between food and pills. The solutions you listed? They work. But they’re not scalable. We need systemic change. That said-start with GoodRx. Ask your doctor. Call the manufacturer. Apply for Extra Help. Even one small step can keep someone alive this month. You are not alone. And you are not failing. The system is.